Overview

This document covers the necessary setup to use Avatax with SalesPad.

Setup

Microsoft Dynamics GP

The customer must have a Sales Tax Schedule of AVATAX, and the Tax Schedule name needs to start with "AVATAX."

Note: In SalesPad Desktop versions 4.4.1.17 and older, Tax Schedules can only be named "AVATAX."

In order to calculate taxes on an item, the item must be set to Taxable or Based on Customer in Microsoft Dynamics GP. If the item is set to Non-Taxable, it will not be sent to Avatax.

SalesPad Settings

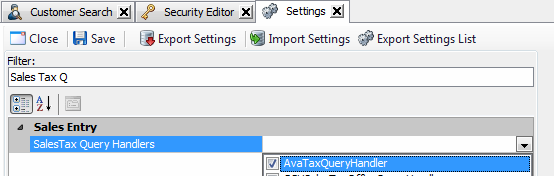

- In the SalesPad Settings module, filter to Sales Tax Q and select AvataxQueryHandler from the dropdown:

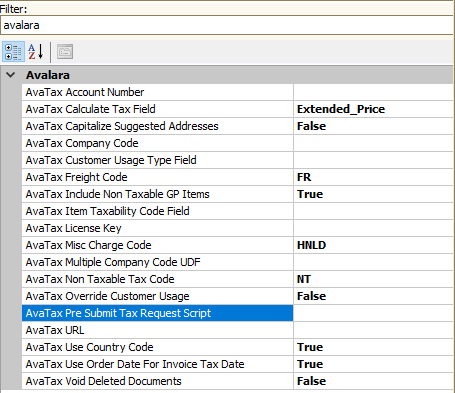

Filter to Avalara and enter these settings:

- AvaTax Account Number: Login account number.

- AvaTax Calculate Tax Field: Line level field that will be used to pass in price. It can be a user-defined field.

- AvaTax Capitalize Suggested Addresses: Capitalize Suggested Addresses returned by Avalara address validation.

- AvaTax Company Code: Company code.

- AvaTax Customer Usage Type Field: Customer address user defined field that stores the usage type.

- AvaTax Freight Code: Code that gets passed in for freight.

- Avatax Include Non Taxable GP Items: Non Taxable GP Items will be passed to Avatax as Non-taxable and the taxcode specified for AvaTax Non Taxable Tax Code

- AvaTax Item Taxability Code Field: Item Master User Defined field that stores the item taxability code.

- AvaTax License Key: License Key.

- AvaTax Misc Charge Code: Code that gets passed in for miscellaneous charge.

- AvaTax Multiple Company Code UDF: UDF that allows for sending a document to a specific company in the avatax console.

- AvaTax Non Taxable Tax Code: This is the Tax Code that will be sent to AvaTax for GP Items that are non-taxable

- AvaTax Override Customer Usage: Use the Sales Line Item Usage Type Field instead of the Customer Address Usage Type Field.

- AvaTax Pre Submit Tax Request Script: C# script that fires off before a tax request is made to Avatax for the document.

- AvaTax Sales Document Fields to Check: Specifies sales document fields to check for updated information before recalculating tax on save; if there is no change, taxes are not recalculated.

- AvaTax Sales Line Item Field to Check: Specifies sales line item fields to check for updated information before recalculating tax on save; if there is no change, taxes are not recalculated.

- AvaTax URL: After filling out the login information click on the Ellipsis Button (…) to validate the URL and account login information. Valid URLs are as follows

- AvaTax Use Country Code: If True then a country code is required.

- Avatax Use Order Date For Invoice Tax Date: When enabled, sets the tax date to pull from the original order's date, not the invoice.

- AvaTax Void Deleted Documents: AvaTax call that sets the document status as Voided when deleting.

eConnect Procedure Fix

If you are using GP 2013, you must run the attached procedure on your database before using Sales Tax Online WS.

If you are using GP 2010, you must run the attached procedure on your database before using Sales Tax Online WS.

Note: After 4.5.0.10 of SalesPad GP, this section is no longer needed.

Use

Once proper setup is complete, during sales document entry, SalesPad will send sales line information to Avatax when saving, and calculated tax amount information will be returned on the document in the Tax field. It is possible to set up workflow and a run script that will calculate taxes only when needed. Returns created from posted invoices will calculate taxes base on the posted invoice date. Additional tax details are stored in the spAvalaraTaxLine and spAvalaraTaxLineDetail tables. (Also see: Avalara Address Validation).

Regardless of whether or not there are fields specified in the AvaTax Sales Document Fields To Check or AvaTax Sales Line Item Fields To Check settings, the document will always have taxes calculated on it on the first save. If there are fields specified in these settings, AvaTax will still calculate tax even if their values haven't been updated on the first save. After the first save, if there are no fields selected in these settings, then AvaTax will recalculate after every save. If there is one or more field specified in the Sales Document Setting, and nothing selected in the AvaTax Sales Document Fields To Check setting, then at least one the specified sales document fields must be updated in order to recalculate taxes on save.

If there is one or more field specified in the AvaTax Sales Line Item Fields To Check setting and nothing selected in the AvaTax Sales Document Fields To Check setting, then at least one of the specified sales line fields must be updated to recalculate taxes on save. If there are one or more fields specified in both settings, at least one of the fields specified in either setting must be modified in order for AvaTax to recalculate taxes.

Note: As of version 4.6.0.7 of SalesPad, the customer purchase order number will import into Avatax from the sales document in SalesPad.

SalesPad Support

Comments