Overview

The ONESOURCE Sales Tax Query Handler is a powerful tool used to calculate taxes on sales documents in SalesPad. This document will provide instructions on how to set up and use the ONESOURCE Sales Tax Query Handler for SalesPad.

Prerequisites

Both of the following must be installed/configured in order to use ONESOURCE Sales Tax Query Handler within SalesPad Desktop:

Note: In Dynamics environments with multiple companies, configuration is performed on a per-company basis

ONESOURCE Determination for Microsoft Dynamics GP

This integration for GP creates essential SQL tables, tax schedules and details, and GP settings that are used by both SalesPad’s integration and the GP integration. This integration is also responsible for handling the audited ONESOURCE calls. SalesPad uses these configurations in conjunction with the additional settings outlined later in this document.

Microsoft Web Services 2.0

Microsoft Web Services 2.0 must be installed in order to use the ONESOURCE Tax Query Handler.

At the time of writing this documentation, the following URL will bring you to the download page for the service (only the runtime files are required for using the plugin):

https://www.microsoft.com/en-us/download/details.aspx?id=23689

Setup

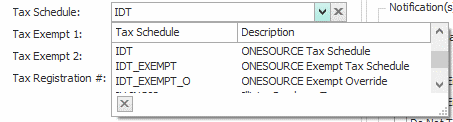

Tax Schedules

Once the ONESOURCE integration for GP has been setup, you'll notice that there are three new tax schedules within SalesPad Desktop (shown in the screenshot below). In order to utilize the OneSource tax engine, the tax Schedule on a sales document must be set to one of the three tax schedules created by the OneSource GP add-on.

Note: The tax schedule on a sales document is rolled down from the customer's 'Ship To Address' for the document

In most cases, "IDT" should be the default tax schedule used for the integration, as "IDT_EXEMPT" and "IDT_EXEMPT_O" are used to signify exemption statuses for a sales document or sales line item.

Note: Tax-exempt customers should be set up in ONESOURCE Determination with an exemption certificate number

The "IDT_EXEMPT" tax schedule allows you to to make a document (or line item) exempt, for a customer that does not have an exemption certificate configured in ONESOURCE Determination.

Note: If the IDT_EXEMPT tax schedule is used, an exemption reason should be provided using an exemption reason user field described in the following section

The "IDT_EXEMPT_O" schedule stands for IDT Exempt Override, and it allows you to override the exemption certificate that's configured in ONESOURCE Determination for a document (or line item).

Exemption Reasons

When the "IDT_EXEMPT" tax schedule is used, an exemption reason should be provided for auditing purposes. There are two ways you can track the exemption reason on a sales document:

- Add a user field to the document (if the document has the "IDT_EXEMPT" tax schedule)

- Add a line item user field (if the "IDT_EXEMPT" tax schedule is set on the line)

Note: These user fields correspond to settings that are expanded upon in the settings section of this document

The valid exemption reasons are as follows:

| Code |

Exempt Reason |

| 05 |

Sales for Resale |

| 10 |

Sales in Interstate Commerce |

| 15 |

Non-taxable Food |

| 20 |

Sales to Government |

| 25 |

Exempt Industrial and Farm Machinery |

| 30 |

Non-taxable Labor or Service |

| 35 |

Prescription Drugs |

| 40 |

Returned Merchandise |

| 45 |

Bad Debts |

| 50 |

Gasoline |

| 55 |

Direct Pay Permit |

| 60 |

Sales to Exempt Organizations (schools, hospitals, non-profit, churches, etc..) |

| 65 |

Food Stamps and WIC Sales |

| 70 |

Medical Equipment |

| 75 |

Broadcasting |

| 80 |

Enterprise Zone |

| 99 |

Other |

These exemption reasons can be input to the user field as the numeric code in the left column, or, they can be selected via quick report user field.

If you'd like to utilize the quick report user field to access this information, use the following quick report:

| <report ReturnColumn="Exempt_Reason"> <query> select Exempt_Reason, Description from ( values ('', ''), ('05', 'Sales for Resale'), ('10', 'Sales in Interstate Commerce'), ('15', 'Non-taxable Food'), ('20', 'Sales to Government'), ('25', 'Exempt Industrial and Farm Machinery'), ('30', 'Non-taxable Labor or Service'), ('35', 'Prescription Drugs'), ('40', 'Returned Merchandise'), ('45', 'Bad Debts'), ('50', 'Gasoline (Motor fuel on which tax is paid)'), ('55', 'Direct Pay Permit'), ('60', 'Sales to Exempt Organizations (schools, hospitals, non-profit, churches, etc.)'), ('65', 'Food Stamps and WIC Sales'), ('70', 'Medical Equipment'), ('75', 'Broadcasting'), ('80', 'Enterprise Zone') ) as Exemption_Reasons (Exempt_Reason, Description) </query> </report> |

Item Product Tax Codes

In order for ONESOURCE to properly calculate taxes, all items sent to ONESOURCE for tax calculation must have a product tax code associated with them. These are set up in GP, and can be found under Tools -> Setup -> ONESOURCE IDT -> Item Taxability.

These should be set up as part of the installation process for ONESOURCE Determination for Microsoft Dynamics GP.

Usage

After the setup is complete, the tax on a document will be calculated whenever the document is saved.

ONESOURCE Sales Tax Lines

The ONESOURCE Sales Tax Lines tab, as shown below, will show details of the total tax applied to each line item as well as the specific amount paid for each tax applied.

Logging for Troubleshooting Purposes

For troubleshooting purposes, logging can be enabled with the ONESOURCE Sales Tax Enable SOAP Logging setting. When this setting is enabled, SalesPad will write an audit on the document of any request/response to and from ONESOURCE.

Additionally, these logs can be found in the System Log Search screen by searching for a Log Source beginning with "ONESOURCE Tax Query Handler".

Security and Application Settings

Security

- ONESOURCE Sales Tax Lines – Allows users to see the ONESOURCE Sales Tax Lines tab on the sales entry screen.

Settings

- SalesTax Query Handlers – Specify the Sales Tax Query Handlers (in the preferred order) to be used. This should be set to include ‘OneSourceSalesTaxQueryHandler’.

Note: There is another 'Handler' settings named ‘OneSourceTaxQueryHandler’ (same name, minus ‘Sales’). This is a legacy version, compatible with an older version of ONESOURCE

- ONESOURCE Auditable Batches – A list of batches in which documents that are saved are audited by ONESOURCE (supersedes ONESOURCE Auditable Doc ID's).

Note: Use of this setting is not recommended, as audited ONESOURCE calls should be performed in GP

- ONESOURCE Auditable Doc IDs – A list of doc IDs that will be passed through to ONESOURCE and logged in their audit tables. If ONESOURCE Auditable Batches is set, that setting will be used instead.

Note: Use of this setting is not recommended, as audited ONESOURCE calls should be performed in GP

- ONESOURCE Bypass Tax Calculation Within Specified Batches – If a document is in a batch specified by this setting, no call will be made to ONESOURCE to calculate its taxes.

- ONESOURCE Connection URL – URL that gives access to the ONESOURCE tax service. Defaults to ‘https://onesource-idt-det-uat-ws.hostedtax.thomsonreuters.com/sabrix/services/taxcalculationservice/2011-09-01/taxcalculationservice’

- ONESOURCE Default Country Code – The default country code used when there is not a Country or Country Code setup on the address or warehouse. Defaults to ‘US’.

- ONESOURCE Document Exemption Reason Field – A sales document user field used to specify a reason for exempt documents. These reasons should match Exempt Reasons in ONESOURCE configuration.

- ONESOURCE Exempt Override Tax Schedule – A tax schedule beginning with IDT to be used on documents or line items that should be taxed, even if the customer is tax-exempt. Defaults to ‘IDT_EXEMPT_O’.

- ONESOURCE Exempt Tax Schedule – A tax schedule beginning with IDT to be used on documents or line items that should be tax-exempt, even for nontax-exempt customers. This Tax Schedule should not be used when a customer has an exemption certificate configured in ONESOURCE. Defaults to ‘IDT_EXEMPT’.

- ONESOURCE External Company ID – External Company ID for ONESOURCE.

- ONESOURCE Line Exemption Reason Field – A sales line item user field used to specify a reason for exempt lines. These reasons should match Exempt Reasons in ONESOURCE configuration.

- ONESOURCE Password – Password for ONESOURCE.

- ONESOURCE Sales Tax Enable SOAP Logging – When enabled, the SOAP Request and Response XML will be audited on the Sales Document. Useful for troubleshooting purposes. Defaults to ‘false’.

- ONESOURCE Product Code for Non-Taxable Items – Specify product code for nontaxable items through ONESOURCE.

- ONESOURCE Use Order Date for Invoice Tax Date – When disabled, the tax date will be the invoice document date. When enabled, the tax date will always be the original order's document date. Defaults to ‘true’.

- ONESOURCE Username – Your ONESOURCE username.

Christian Hartford

Comments