Overview

This document covers the necessary setup to use CCH Sales Tax Online WS with SalesPad.

Note: This feature may not be in versions prior to 4.2

Setup

Dynamics GP

The Sales Tax Demand and Sales Tax Detail settings in Microsoft Dynamics GP must contain STO or CCH. If the Country Code is left blank, STO defaults the Country Code to US. Canadian addresses must have a Country Code.

Note: Country Codes set up in Dynamics GP can be selected in SalesPad from the Contact card (Customer Card > Customer Addresses tab > Double-click contact).

In order to calculate taxes on an item, the item must be set to Taxable or Based on Customer in Dynamics GP. If the item is set to Non-Taxable, it will not be sent to Sales Tax Online WS.

SalesPad Settings

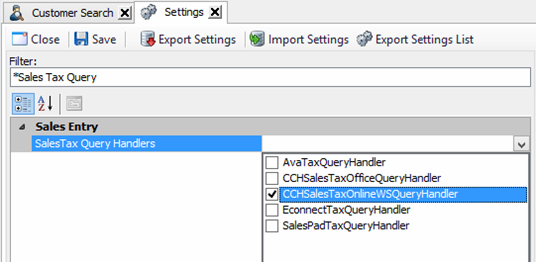

- In the SalesPad Settings module, filter to Sales Tax Q and select CCHSalesTaxOnlineWSQueryHandler from the dropdown:

- Filter to CCH Sales Tax Online and enter these settings:

SalesTax Online Freight Item - The Item number that will be used for Freight

SalesTax Online Connection Settings:

SalesTax Online Location: Location SalesTax

Online Nexus: Nexus SalesTax

Online ReferredID: Referred ID

SalesTax Online Serial Number: Serial Number

Download spcpAvataxPreSave and spcpAvataxPostSave at the end of the document.

eConnect Procedure Fix

If you are using GP 2013, you must run the appropriate procedure attached to the end of the document on your database before using Sales Tax Online WS.

If you are using GP 2010, you must run the appropriate procedure attached to the end of the document on your database before using Sales Tax Online WS.

Note: After 4.3.2.13 of SalesPad GP, this section is no longer needed.

Use

Once proper setup is complete, during sales document entry, SalesPad will send sales line information to Sales Tax Office and calculated tax amount information will be returned on the document in the Tax field. It is possible to set up workflow and a run script that will calculate taxes only when needed.

SalesPad Support

Comments